Managing finances can be a daunting task for many people. However, with the help of some clever financial hacks, you can save money, reduce debt and achieve your financial goals.

1. Automate Your Savings

One of the easiest ways to save money is to automate your savings. Set up a direct deposit from your paycheck to a savings account. You can also set up an automatic transfer from your checking account to your savings account every month. By doing this, you will not only save money but also avoid the temptation of spending it.

2. Track Your Expenses

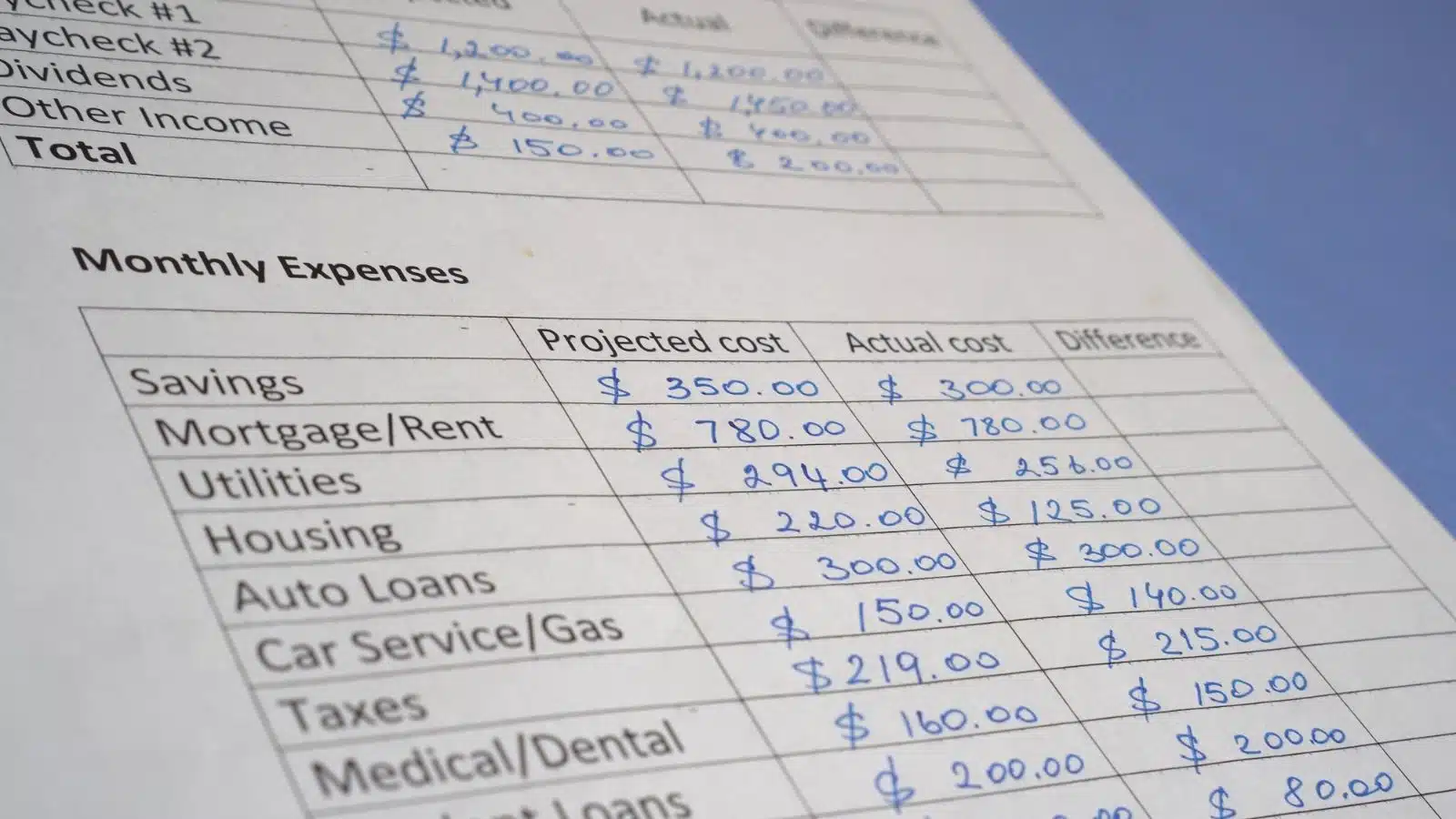

Keeping track of your expenses is an essential part of managing your finances. You can use budgeting apps or spreadsheets to track your expenses. By doing so, you will be able to identify areas where you can cut back and save money.

3. Use Cashback and Rewards Programs

Many credit cards and websites offer cashback and rewards programs that you can take advantage of. By using these programs, you can earn cashback or rewards for your purchases. Some programs even offer sign-up bonuses, which can be a great way to earn some extra money.

4. Negotiate Your Bills

You can negotiate your bills with service providers like cable, internet, and phone companies. Call and ask if they can offer you a better deal. You can also do research to find out what other providers are offering and use that information to negotiate a better deal.

5. Buy Generic Brands

Generic brands are often just as good as name-brand products but are significantly cheaper. When shopping, opt for generic brands to save money. You can also compare prices of different brands to find the best deal.

6. Pay Off Debt Strategically

If you have debt, it’s essential to pay it off strategically. Focus on paying off high-interest debt first, like credit card debt. You can also consider consolidating your debt into a single loan with a lower interest rate.

7. Invest in Yourself

Investing in yourself can pay off in the long run. Take courses, attend conferences, and read books to improve your skills and knowledge. By doing so, you will increase your earning potential and improve your overall financial situation.

8. Take Advantage of Free Trials

Many subscription services offer free trials, which can be a great way to save money. For example, you can sign up for a free trial of a streaming service, cancel before the trial period ends, and repeat with another service. Be sure to cancel before the trial period ends to avoid being charged.

9. Shop Second-Hand

Shopping for second-hand items can save you a lot of money. Look for items like clothing, furniture, and appliances at thrift stores, garage sales, and online marketplaces. You can often find items that are in excellent condition for a fraction of the cost of new items.

10. Make Your Own Meals

Eating out can be expensive, so try to make your own meals at home as much as possible. Plan your meals ahead of time and buy groceries in bulk to save even more money. You can also try meal prepping to save time and money during the week.

Personal Finance Lessons $50,000+ of Debt Taught Me

Personal Finance Lessons $50,000+ of Debt Taught Me

The Number One Reason Most People Are Broke Or Have No Emergency Fund

The Number One Reason Most People Are Broke Or Have No Emergency Fund

7 Side Hustle Ideas That Have Full-Time Income Potential

7 Side Hustle Ideas That Have Full-Time Income Potential

How To Invest $20: Make Your Money Work For You

How To Invest $20: Make Your Money Work For You

Should You Invest Your Emergency Fund? [The Complete Answer]

Should You Invest Your Emergency Fund? [The Complete Answer]

This article was produced and syndicated by Invested Wallet.

Source: Reddit.