But whatever it may be, most Americans are in pretty bad shape if some expensive issue comes up.

Because of a lack of prep, many times people are forced to rack up credit card debt to pay for the expense or get tons of late notices with extra fees thus essentially getting stuck with more and more bills, costing you a chance to stack that money away.

Yet, what’s even scarier is the lack of savings the groups of 35 and under have saved. Whether that is for an emergency fund or retirement.

In a Business Insider article, they broke down savings rates by different categories by using data from the Federal Reserve’s Survey of Consumer Finances.

First, average savings account balance by age, which was not looking too pretty:

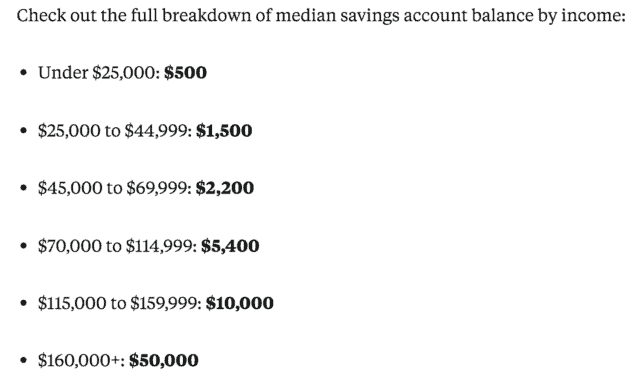

Another section they broke down, was the median savings account balance by income:

Understandably, higher earners are able to save more money and the older people get, the more money they will have because of time being on their side.

It also makes sense for the 35 and under group to have low savings for a few reasons: Paying off student loans, just developing their careers, maybe still going to school, etc.

Of course all the above can attribute to other things, these are just some examples.

But, we also know people with low incomes have amassed huge retirement or savings fortunes, so a lack of income is not necessarily the main cause.

So, why do people seem to have no money or struggle to save?

Before I dive in, I know it can be tough out there. Stagnant wages, climbing student debt, job loss, etc. Everyone has a unique situation, but many also would be better financially off if they did this one thing. Do you know what it is?

Live Below Your Means.

It’s a pretty simple concept in theory, but sometimes it is much harder for people to follow in the long run. This is a big problem for a lot of people and most may not even realize it.

The short definition of living below your means is simple: you should be spending less than you earn, making smart purchasing decisions, and not having to live paycheck to paycheck.

Whether that’s downgrading your car, living in an affordable apartment or house, not going out to eat every day, etc.

This also can coincide with the phrase, “Keeping up with the Joneses.”

We are so worried about what others have: fancy cars, big houses, expensive jewelry, new clothes, etc. that whether we intentionally do it or not, we keep purchasing and upgrading our own possessions.

Of course, there are times where it is okay to treat yourself, but it should be occasional.

I’ve personally struggled with living below your means a few years ago before really diving into personal finance.

I bought a new car right when I got my first job, stayed in an apartment that I could barely afford at the time, etc. None of this was to be flashy or brag, but me wanting to be independent.

I just happened to make the wrong financial moves and was impulsive on decisions.

Misconceptions about living below your means

I think a big misconception with living below your means is automatically assuming you have to be extremely frugal, to the point of being cheap. Or that you have to live a bare-bones lifestyle.

But that’s false.

You can still have a good time and enjoy life, plus not be scrambling to come up with money for a bill every week or an emergency.

That is stressful and not good on your pockets, and more importantly, not good for your health.

A lot of this too is how you think you look to others from a financial standpoint.

Your friend gets a brand new car, for example. And you don’t want to feel left behind or that they are judging you for driving the same old car for the last 10 years.

But many times, those are the people who have fallen to the trap of not living below their means and probably do not have much saved or may be financially struggling. Be comfortable with your finances and don’t worry how others perceive you.

A great book that talks a lot about this and one of my favorite money books is The Millionaire Next Door: The Surprising Secrets of America’s Wealthy, by Thomas J. Stanley and William D. Danko.

The authors discuss how many of the millionaires out there, you’d never know because they don’t act like they have money, afford to splurge, or buying bigger and better things. Highly recommend.

How can you start to live below your means?

It might be a bit of a challenge to figure out where you are going wrong financially, but it is easier than you think. You will need to sit down and face the truth.

But, here are some things you can do to so you start living below your means.

Cut wasteful spending

The simplest thing you can do right now is to make a list of all the things you spend money on frequently. Look at that list and see what are things that are necessary versus things that really don’t improve your quality of life.

Don’t watch T.V.? Cancel cable and go for a cheaper option like Netflix. Going out to eat a few times a week? Cut back to once a week or cut it to once a month.

Sometimes we do not even realize the number of things we spend on that we really wouldn’t miss if we didn’t have it.

I’ve cut cable, cut back on restaurants, and rarely buy new stuff. And quite frankly, once it was gone, I didn’t miss it and was easier to avoid falling back into the trap. You can use a service like Trim to help you negotiate bills and find unwanted subscriptions.

Refinance to pay less interest

A big killer for the millennials and the younger generation is the growing and burdening interest rates on student loans. Yet, this can also apply to other loans you might have, say a car loan or even credit card interest.

If you have high-interest rates on student loans, consider refinancing with through a service like Credible, which has a ton of options for you.

With Credible, you can compare prequalified student loan refinancing rates from lenders without affecting your credit score. 100% free! Get started here.

Or if you have a higher interest credit card and if you have a decent credit score, you might be eligible for a balance transfer credit card at 0% interest for a period of time.

Just watch out for transfer fees and other fine print. But this can help you breathe a bit easier.

Be smart with your home or car purchases

We all want nice spacious homes or a new car that we know has no problems or accidents on record. But you know what, it’s also killing your wallet.

Hold back from buying the most expensive house the bank says you are able to afford, they are loan happy and will get you on interest. And don’t forget taxes, insurance, and HOA’s that can also add up.

Plus, if you lose your job or have an unexpected expense, you can be in for a world of hurt with a pricey home.

That’s why you shouldn’t choose the most expensive home you can afford, find one that gives you some cushion. Even if it needs some updates, you can fix it up.

Same applies when purchasing a car. A brand new car depreciates as soon as you drive it off the lot.

“The second you drive a new car off the lot it will depreciate by as much as 11% of its value, and can lose up to 30% in the first year.” (Source). Yikes!

Guess who made that mistake a few months after starting his first big boy job after college? Yup, me.

The payment and interest rate was not terrible, but add that to the $400+ a month of student loans I was paying, probably was not a smart choice. Lesson learned.

There is nothing wrong with buying a new car if you have the means to do so. But even then, is it worth losing almost 30% in value after one year?

Buying a used car is the way to go and you can still get some certified pre-owned to ensure it is not a lemon.

Pay yourself first

For most of us, we pay our bills and any expenses first. Then whatever is left, we sock away for our savings.

Sounds like the right move because otherwise you accrue late charges or have bills sent to claims. Nobody wants that.

Yet, you know what happens most of the time? After bills, expenses, and using it towards other things, there is little to actually save.

We are conscious of that money in our checking and might use it on extra purchases, then decide to move money to save.

Instead, you should reverse your mindset.

Whenever you get paid, the first thing you should do is move a set amount to your savings that will not be touched. This keeps you from having money easily accessible in your checking to spend and makes you budget better for your bills.

This also sets you up to find ways to increase your savings rate, thus building your savings account further. The pay yourself first mindset is what helped me invest and save while still tackling debt in a few years.

What are you doing to live below your means and build your savings?