Student loans can be a significant financial burden for many people, especially as the average loan balance continues to rise. Paying off student loans can take years or even decades, causing stress and limiting financial freedom.

Fortunately, there are expert tips and strategies that can help you pay off your student loans as quickly as possible. From making extra payments to taking advantage of forgiveness programs, these tips can help you take control of your student loan debt and move towards a more financially secure future.

1. Make Extra Payments Whenever Possible

One of the best ways to pay off your student loans faster is to make extra payments whenever possible. This could mean putting a portion of your tax refund towards your loans or making an additional payment each month. Even small extra payments can make a big difference in the long run.

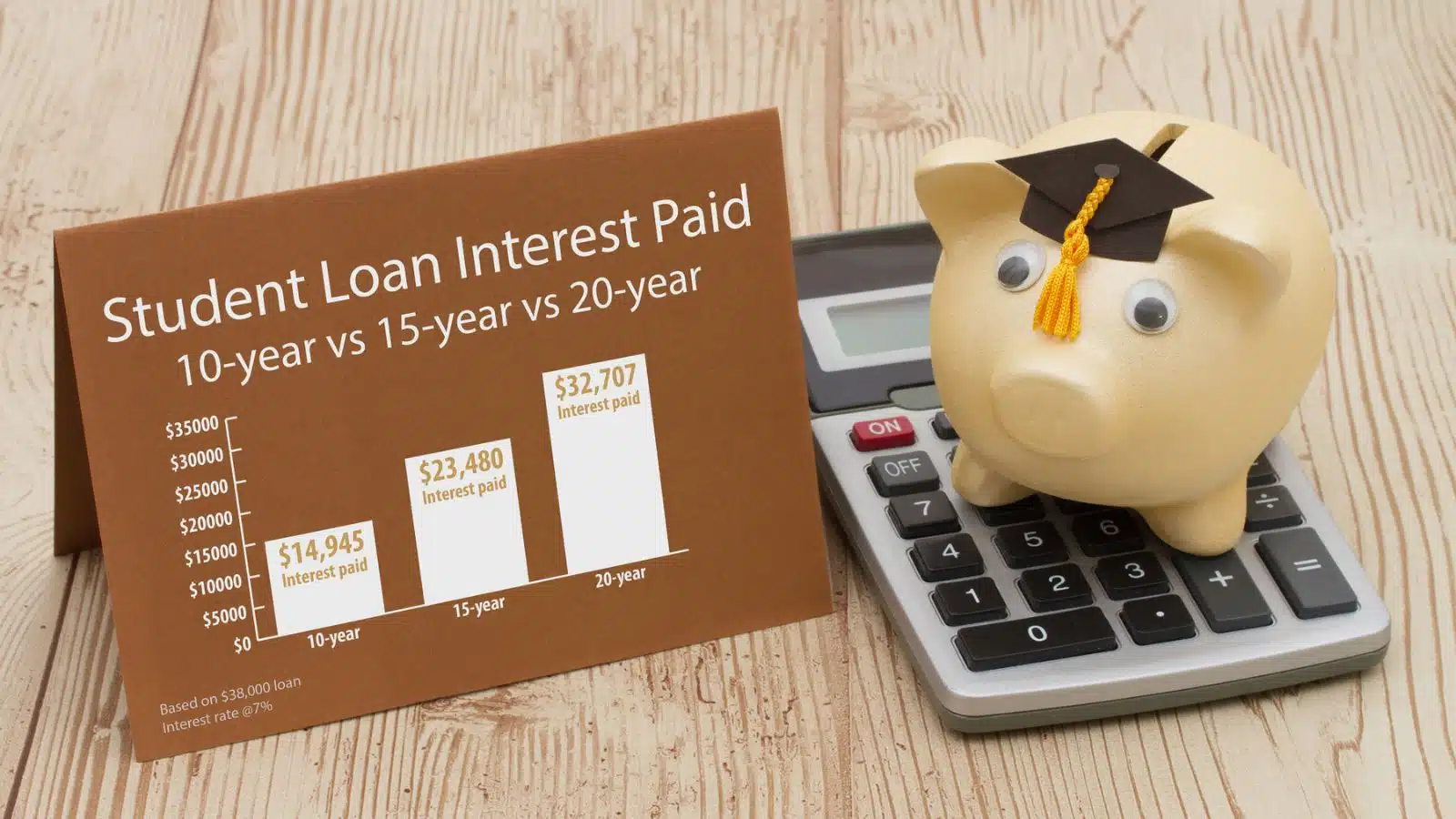

2. Consider Refinancing Your Loans

If you have good credit and a steady income, you may be able to refinance your student loans at a lower interest rate. This could lower your monthly payments and allow you to pay off your loans faster. However, it’s important to weigh the pros and cons of refinancing and make sure you’re getting a good deal.

Follow Invested Wallet For More

If you’ve enjoyed reading our content and are passionate about learning wealth, managing your finances, and achieving financial freedom, we’d love for you to join our community! Click here to follow Invested Wallet for more.

3. Use the Debt Avalanche Method

The debt avalanche method involves paying off your highest-interest loans first while making minimum payments on the rest. Once you’ve paid off the highest-interest loan, you move on to the next highest-interest loan and so on. This method can help you save money on interest over time and pay off your loans faster.

4. Make Biweekly Payments

Instead of making one monthly payment, consider making biweekly payments. This can help you pay off your loans faster because you’ll be making the equivalent of an extra payment each year. Just make sure to check with your loan servicer to ensure that you won’t be charged any prepayment penalties.

5. Live Frugally

One of the best ways to pay off your student loans ASAP is to live frugally. This means cutting back on unnecessary expenses and living below your means. The money you save can be put towards your loans, helping you pay them off faster.

6. Consider Student Loan Forgiveness Programs

If you work in certain public service fields, such as education or healthcare, you may be eligible for student loan forgiveness programs. These programs forgive some or all of your student loan debt after a certain number of years of service. Make sure to research all of the eligibility requirements and weigh the pros and cons before committing to a forgiveness program.

7. Take Advantage of Employer Contributions

Some employers offer student loan repayment assistance as a benefit to their employees. This means that your employer will make payments towards your student loans on your behalf. Make sure to check with your employer to see if this benefit is offered and if you’re eligible.

8. Cut Back on Interest by Paying off Capitalized Interest

Capitalized interest is interest that accrues on your student loans while you’re still in school. This interest is added to your principal balance when your loans enter repayment, which can increase the total amount you owe. By paying off the capitalized interest while you’re still in school, you can reduce the amount of interest you’ll pay over the life of your loans.

9. Take Advantage of Tax Deductions

You may be eligible for tax deductions on the interest you pay on your student loans. This can help reduce the overall cost of your loans and allow you to pay them off faster. Make sure to consult with a tax professional to see if you’re eligible for any student loan-related tax deductions.

10. Automate Your Payments

One of the easiest ways to pay off your student loans faster is to automate your payments. By setting up automatic payments, you’ll never miss a payment and you may be eligible for a lower interest rate. Just make sure to have enough money in your account to cover the payments each month.

Follow Invested Wallet For More

If you’ve enjoyed reading our content and are passionate about learning wealth, managing your finances, and achieving financial freedom, we’d love for you to join our community! Click here to follow Invested Wallet for more.