Paying off debt can be a challenging goal for many people. It requires discipline, patience, and a solid plan. People make many common mistakes when trying to pay off debt, which can make the process more difficult and prolong the time it takes to become debt-free. By avoiding these mistakes, you can create a more effective debt repayment plan and achieve your financial goals more quickly.

1. Not Creating a Budget

One of people’s biggest mistakes when paying off debt is not creating a budget. Without a budget, knowing where your money is going and how much you can allocate toward debt repayment can be challenging. Creating a budget will allow you to see where to cut expenses and put more money toward your debt.

2. Ignoring High-Interest Debt

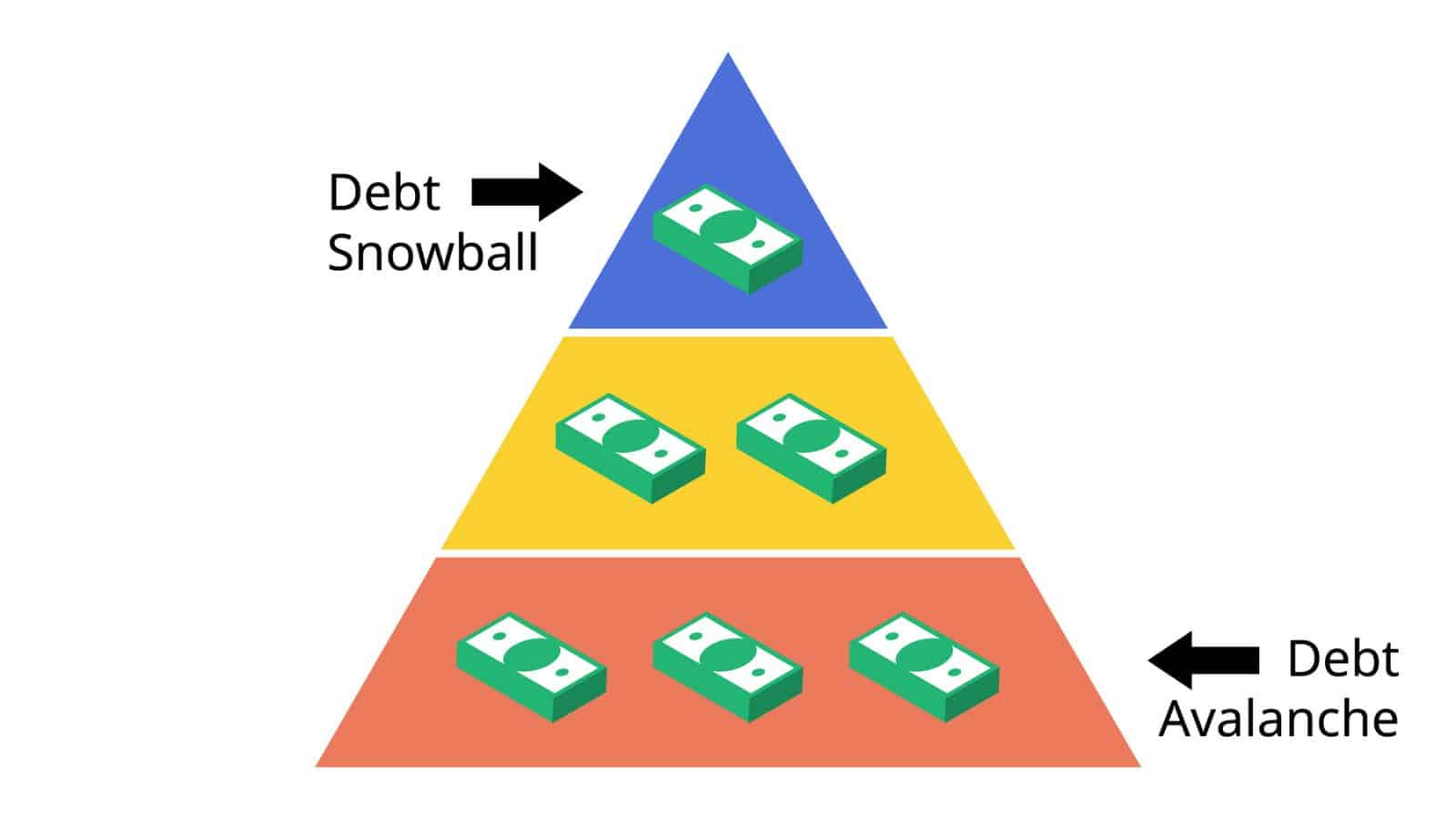

Another mistake to avoid is ignoring high-interest debt. High-interest debt, such as credit card debt, can quickly accumulate interest and become unmanageable. It’s essential to prioritize paying off high-interest debt first to save money in interest charges.

3. Making Only Minimum Payments

Making only minimum payments is a common mistake people make when trying to pay off debt. While making only the minimum payments may be tempting, this will result in paying more in interest charges over time. Instead, try to pay more than the minimum payment each month to pay off your debt faster.

4. Using Debt Consolidation Without a Plan

Debt consolidation can be a valuable tool for paying off debt, but it’s essential to have a plan in place. Consolidating debt without a plan can lead to accumulating more debt and not paying it off efficiently. It’s critical to understand the terms of your consolidation loan and have a plan for paying it off.

5. Not Seeking Help

Not seeking help is a mistake to avoid when paying off debt. Many resources, such as credit counseling and financial advisors, are available to help you create a plan for paying off debt. Don’t be afraid to seek professional help and advice to help you achieve your financial goals.

6. Not Tracking Progress

One mistake many people make is not tracking their progress when paying off debt. Monitoring your progress to stay motivated and adjusting your plan if necessary is essential. Consider using a debt repayment tracker or spreadsheet to help you visualize your progress.

7. Continuing to Use Credit Cards

Continuing to use credit cards is another mistake to avoid when trying to pay off debt. If you’re still using credit cards while trying to pay off debt, you risk accumulating even more debt. Consider putting your credit cards away and using cash or a debit card instead.

8. Neglecting Emergency Savings

Neglecting emergency savings is a common mistake when trying to pay off debt. Emergencies can happen at any time, and if you don’t have savings set aside, you may have to rely on credit cards or loans to cover unexpected expenses. Aim to set aside three to six months of living expenses in an emergency fund.

9. Focusing Solely on Debt Repayment

While paying off debt should be a priority, it’s essential not to neglect other financial goals. For example, if you have an employer-sponsored retirement plan, such as a 401(k), it’s necessary to continue contributing to it, even if you’re also paying off debt.

10. Ignoring Your Credit Score

Your credit score plays a significant role in your financial life, and neglecting it can be a mistake when paying off debt. Late payments and high credit utilization can harm your credit score. Focus on making on-time payments and reducing your credit utilization to improve your credit score.

50 Super Simple Side Hustle Ideas

50 Super Simple Side Hustle Ideas (& How to Make Them Work)

10 Frugal Lessons I Learned From Being Flat Out Broke

Creative Ways To Make Money

20 Easy Ways to Raise A Credit Score Fast

Read More: 20 Easy Ways to Raise A Credit Score Fast

Frugal Living Tips: The Essential Guide To Start Saving Money

Frugal Living Tips: The Essential Guide To Start Saving Money