If you’re looking for an affordable term life insurance policy that you can obtain quickly, you need to check out Ladder Life. Their streamlined online application can have you approved in a matter of minutes. And according to Ladder Life, many applications are approved without a medical exam requirement.

In this Ladder Life review, I’ll let you know what types of policies they offer, key features, who is eligible, and how much you can expect to pay.

Introducing Ladder Life Insurance

Ladder Life is a California-based online life insurance provider offering coverage through established life insurance companies. Founded in 2015 and launched in 2017, Ladder Life’s insurance partners include Allianz Life Insurance Company of New York, Fidelity Security Life Insurance Company, and Allianz Life Insurance Company of North America.

While the entire application process is online, you can get help from licensed insurance professionals if needed. Ladder Life’s advisors work on salary, not commissions. They aren’t rewarded for selling you more insurance than you need or pushing products designed primarily to enhance their own incomes.

How Ladder Life Term Insurance Works

Ladder Life only offers term life insurance policies. Ladder’s mission is to provide the lowest-cost policies in the shortest time possible. Term life insurance best fits that product type.

When applying with Ladder Life, you should be aware the company does not offer policy riders. These optional additional coverage provisions provide more benefits but at a higher premium. That higher premium is the reason why Ladder Life doesn’t offer them.

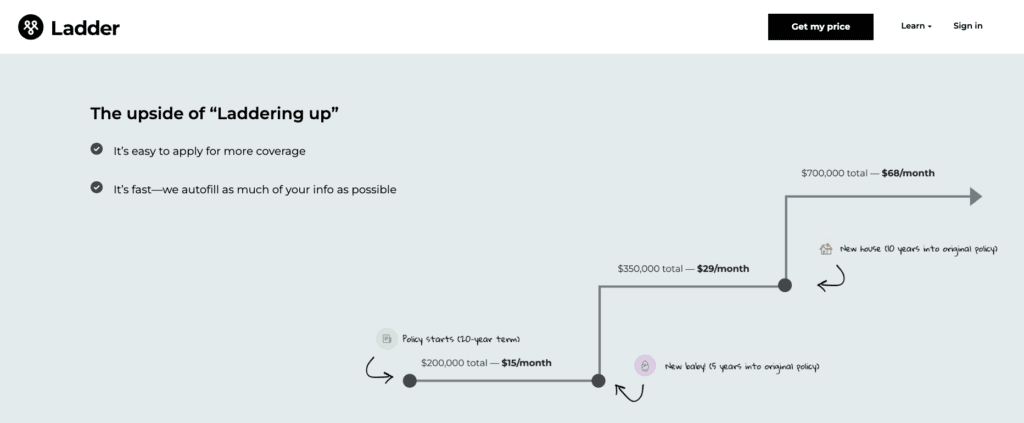

Ladder Life’s most unique feature is that it allows you to increase or decrease your coverage as needed.

Laddering Up/Laddering Down

The name Ladder Life hints at its most unique feature – the ability to increase or decrease your coverage as needed. The process is known as ‘laddering up’ or ‘laddering down.’ Existing policyholders can increase their death benefit amount as their needs change.

Conversely, if your coverage needs decline, you can reduce the death benefit. In short, Ladder Life puts you in charge of the policy’s face amount and the premium you’ll pay. You can request a change to your coverage by visiting the Ladder Life account page.

Laddering your policy, up or down, is completely free. And you can ladder your policy as often as you like. Naturally, the premium will increase if you ladder up the policy amount. And if you ladder down the death benefit, the premium will decrease.

Term Length Options

Ladder Life offers terms ranging from 10 to 30 years, the maximum term you can qualify for, regardless of age. That said, your age at the time of application may reduce the maximum term you qualify for.

Ladder Life uses a simple calculation to determine the maximum term length of a policy. Your current age, plus the term length, cannot exceed 70. For example, if you’re 40, the longest term is 30 years (40+30 = 70.) If you’re 50, the longest term is 20 years (50+20 = 70.)

Ladder Life policies are underwritten based on your nearest birthday. For example, if you will be 45 in four months, your age will be considered 45 years, not 44.

Your premium will increase in 5-year increments. The new premium will be based on your age at renewal and, therefore, higher, but this is how term life insurance renewals work.

Ladder Life Pricing

Like all life insurance policies, Ladder Life policy premiums depend on a combination of factors. Those include your age at the time of application, health condition, occupation, hobbies and pastimes, and even geographic location.

We requested information for a non-smoking 40-year-old male in excellent health with no family history of major illnesses, and we received the following quotes for $1 million in coverage:

- 10 years – $37.50 per month

- 15 years – $47.70 per month

- 20 years – $61.80 per month

- 25 years – $96.90 per month

- 30 years – $114.30 per month

We then requested a policy for a non-smoking 40-year-old female in excellent health with no family history of major illnesses, and we received the following quotes for $1 million in coverage:

- 10 years – $35.40 per month

- 15 years – $46.80 per month

- 20 years – $52.50 per month

- 25 years – $77.10 per month

- 30 years – $88.50 per month

The monthly premiums for men are slightly higher than for women, which is common throughout the life insurance industry. This owes to the fact that women statistically live longer than men by several years.

The premium rate increases with the term of the policy because the longer the term, the greater the likelihood the company will ultimately pay the death benefit.

Ladder Life Maximum Coverage Limits

Ladder Life coverage limits range from a minimum of $100,000 to as much as $3 million. They will go as high as $8 million, but applicants applying for benefits greater than $3 million will need to complete a full application and submit to a medical exam.

Ladder Life policies have a single death benefit payout, which is paid in a lump sum to the beneficiaries. upon the death of the insured. Unlike some life insurance companies, there is no option to distribute benefits in installments or through any other payout method.

As mentioned, Ladder Life does not offer common life insurance riders, so you won’t have the ability to add provisions, such as a spousal rider, an accelerated death benefit (living benefits), double indemnity (increased death benefit for death caused by an accident), or a conversion provision that enables you to convert the term policy to a permanent, whole life policy before the term expires.

Ladder Life Coverage Eligibility

Ladder Life offers coverage for those between the ages of 20 and 60. If you are over 60, you’ll need to make an application elsewhere. Each application is for a single individual, so there is no capability to apply jointly with your spouse or to add your children. Each person will need to complete a separate application.

Policies are available only to US citizens and lawful permanent resident aliens who have lived in the US for at least two years. Ladder Life provides policies in all 50 states, as well as the District of Columbia.

Ladder Life Application Process

The application process takes place online, which helps Ladder Life keeps premiums low.

You can obtain coverage in as little as a few minutes. You will often not be required to complete a medical exam. Ladder uses available medical databases in evaluating each application. If your medical history warrants, no exam will be necessary.

But if your health profile or application indicates the need for a medical exam, approval may be delayed several weeks.

Ladder Life Underwriting

When completing the application, Ladder Life will request basic information, like your name and email address. In making the underwriting decision, they’ll also request the following information:

- Your height and weight

- The last time you used tobacco or nicotine products

- Your date of birth

- Whether a biological parent or sibling been diagnosed by a physician with diabetes, cancer, heart disease, Huntington’s Disease, or Lynch Syndrome before the age of 60?

- Your annual household income

- How many children you have

- Your remaining mortgage balance

Your answers to these questions will determine your eligibility for life insurance coverage, as well as the premium you’ll pay for the policy.

Is Ladder Life Legit?

Ladder Life is a legitimate term life insurance provider, offering policies in all 50 US states. The following information indicates its financial strength and how it’s perceived within the insurance industry and by its customers.

Financial Strength

Since Ladder Life is not the direct issuer of the policies they offer, the company is not rated for financial strength by A.M. Best, the industry’s most well-recognized insurance company rating agency.

But the ratings for Ladder Life’s issuing companies are as follows:

- Allianz Life Insurance Company of New York, A+ (Superior)

- Fidelity Security Life Insurance Company, A (Excellent)

- Allianz Life Insurance Company of North America, A+ (Superior)

Since each of the three companies is “A” rated by A.M. Best, each is highly likely to have the financial strength to pay the policy death benefit, if necessary.

Third-Party Ratings

In addition to financial strength ratings by A.M. Best, we’ve also considered the credit rating of each of the three providers behind Ladder Life. The credit rating indicates the company’s ability to meet its financial obligations and continue operations as a going concern.

The news here is as good as it is with the financial strength ratings. The table below shows the credit ratings of each of the three companies from two major corporate credit evaluation agencies:

| Insurance Company / Rating Service | Moody’s | Standard & Poor’s |

| Allianz Life Insurance Company of New York | A1 (5th of 21 ratings) | AA (3rd of 21 ratings) |

| Fidelity Security Life Insurance Company | N/A | N/A |

| Allianz Life Insurance Company of North America | AA | Aa3 |

Customer Service Ratings

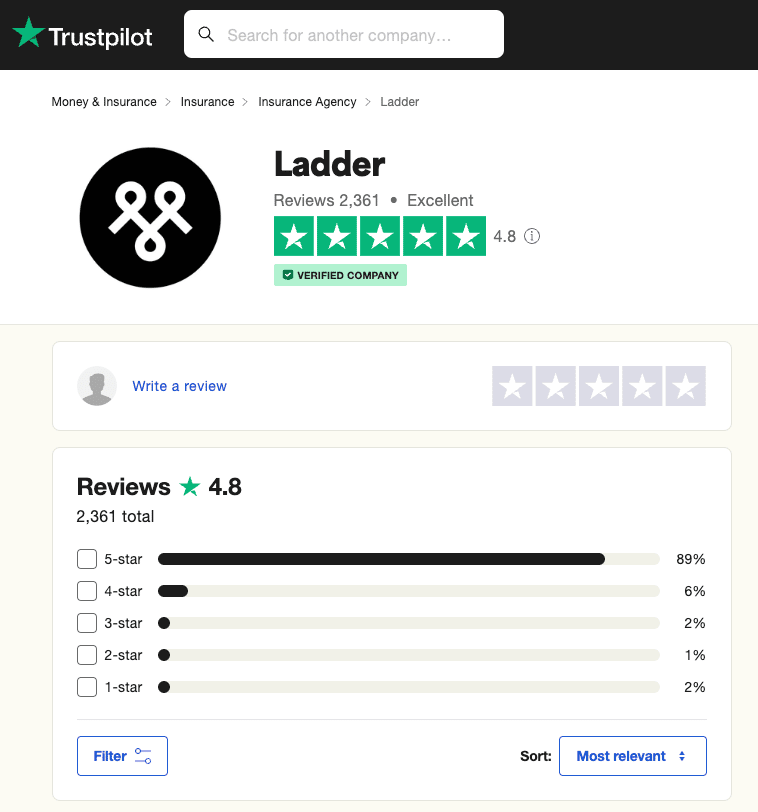

Perhaps the best indicator of Ladder Life’s reputation as a life insurance provider is to look at the ratings provided by the people who deal most closely with Ladder Life – its customers. Ladder Life has an Excellent Trustpilot score of 4.8/5, based on almost 2400 customer reviews. 89% of customers have assigned them a 5-star rating, and only 5 % rated them three stars or fewer.

We could not locate a rating for Ladder Life with the Better Business Bureau. However, the BBB has an “A+” (highest) rating for Allianz Life Insurance Company of North America, and the company has been accredited by the agency since 1972.

Fidelity Security Life Insurance Company has a BBB rating of A+ and has been agency accredited since 1990. There is, however, no BBB rating for Allianz Life Insurance Company of New York, perhaps because the company, along with Allianz Life Insurance Company of North America, are affiliated organizations.

How We Evaluated Ladder Life Insurance

We’ve evaluated Ladder Life based on the policy terms offered, the dollar amount of the death benefits, and the premiums’ cost. We’ve also taken into account applicant eligibility, as well as the apparent underwriting criteria the company uses.

We’ve also considered third-party information about the company, including its financial strength and reputation. Finally, we considered factors that make Ladder Life unique regarding what niche they fill in the insurance industry.

Ladder Life Pros and Cons

There’s a lot to like about Ladder Life, but it does lack some key features people look for when shopping for life insurance. Whether or not that matters to you will depend on what you want in a life insurance policy. Here’s our list of Ladder Life’s pros and cons.

Pros

- Affordable term life insurance

- Complete your entire application online

- Good chance of no medical exam (if you’re in good health)

- High maximum coverage of $8MM

- Ladder up or down to change your existing insurance coverage

- Excellent Trustpilot rating from Ladder Life customers

Cons

- Only offers term life insurance

- You cannot add insurance riders to your coverage

Is Ladder Life a Good Company?

Ladder Life is one of the best online life insurance companies for term insurance. While they don’t offer as many coverage options as other providers (term life only, no riders), they provide straightforward term coverage that’s affordable and easy to apply for. You can complete the entire process online, and if you’re in good health, you likely won’t require a medical exam.

Ladder Life partners with top-notch insurance companies and can boast very high customer ratings. And their Ladder Up/Down features only add to Ladder Life’s convenience.

Of course, if you fall outside Ladder Life’s qualifying criteria, i.e., over 60, want universal or whole life insurance, or require specialized coverage via insurance riders, then Ladder Life is not for you.

The bottom line is if you meet Ladder Life’s age requirements and are of good health, it’s one of the best places to get term life insurance – which is what the vast majority of American adults need.