It is good to explore new ways to save money. But sometimes in our quest for fresh ideas, we forget the basics that served us so well in the past.

When that happens, take a step back and brush up on those neglected, tried-and-true methods.

All these money-saving tips have a theme in common: The details matter. Being vigilant in all areas of our financial lives — from the big stuff to the small stuff — can make a real impact on our bottom line.

Here are some classic money-saving tips worth another look.

1. Buy used

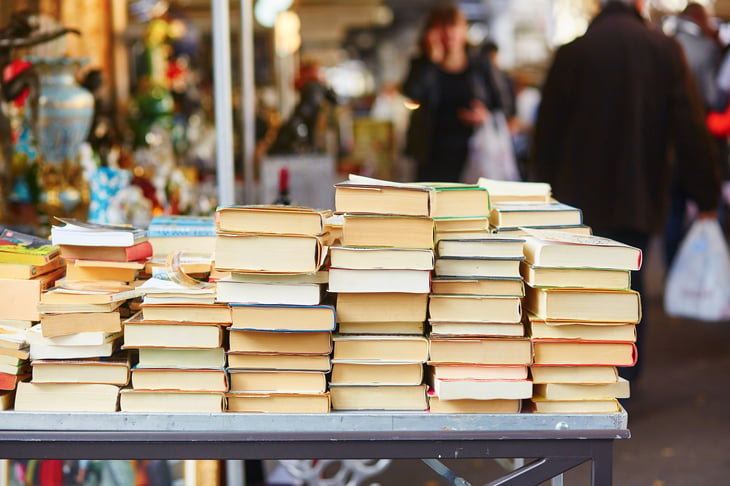

Let someone else take depreciation on the chin. Buying used is one of the best money-saving moves, whether it’s previously owned cars, secondhand appliances in good working order, or gently used clothes and books.

Don’t wait until you need an item to buy it; instead, plan ahead. Think about what your family will need three months or six months down the road.

Then, look for bargains. During the dog days of summer, scour thrift stores for great winter clothes. In autumn, pick up a used patio set from the classifieds.

Of course, not everything that is secondhand is a good buy. For more, check out “10 Things You Should Never Buy Used.”

2. Lighten up on the utilities

I’m a child of the ’70s and distinctly remember the first energy crisis during that decade. It seemed like, overnight, the country developed an energy conscience and began trying to conserve.

I still watch our use of utilities closely today — turning off lights when I leave a room, using dimmer switches and keeping the thermostat set at reasonable temperatures as the seasons change.

You can do it too. One very simple way to start is to install energy-saving compact fluorescent bulbs. Keeping utility costs in check saves money and reduces our carbon footprint at the same time.

3. Skip the treat (sometimes)

Don’t get me wrong: What fun would life be without a little indulgence? But for the frugal-minded, a treat that happens every day is no longer a treat — it’s overhead.

Will that treat be any less delicious if you make it at home and skip the retail markup and long lines? We all have our own “latte factor” in life, but remembering to keep our treats in line with our budget is essential when trying to save.

4. Buy in bulk

Rather than focusing on sale prices for individual items, compare prices per ounce or per unit. Often, buying in bulk makes more financial sense.

But keep three things in mind when buying in bulk:

- Don’t buy more than you have room to store (or share).

- Buy only those products you actually will use.

- For perishable grocery items, make sure you’re not buying so much that you won’t have time to use them before they go bad.

5. Ride a bike

You can save a lot of money by commuting to work by bike a few times a week or by using a bike for local errands. Besides avoiding the expenses of fuel, parking and wear and tear on your car, you will get a free cardio workout.

6. Learn a money-saving skill

If you’re focused on frugal living, explore hobbies and activities that are enjoyable and that also help your bottom line.

Learn to plant a vegetable or herb garden, try your hand at basic car and home repair projects, or learn to refinish furniture.

7. Save the raise

If you get a raise but can still make ends meet on your pre-raise salary, consider pocketing the extra cash and putting it toward your retirement savings or other investments.

Of course, you need to land that raise first. For more ideas, check out “10 Tips to Remember When Asking for a Raise.”

Also, put other “found cash” into savings, including any tax refund or quarterly bonus.