The best time to ensure you receive the biggest possible tax refund for 2022 was before 2022 ended.

The good news is that it’s not too late to try to get a larger refund for the 2022 tax year, the one for which your return is due by April 18.

Here are some steps to review before filing your 2022 federal income tax return to ensure you get as big of a refund, or as small of a tax bill, as is possible at this point.

Bigger refunds aren’t always better

Getting a big tax refund might sound great, but a larger refund can also mean you are withholding too much tax from your paycheck. That means Uncle Sam gets to use your money interest-free during the tax year.

If you’re not sure if you are withholding the right amount, use the IRS’ free Tax Withholding Estimator tool. Then, if you want to change your withholding, fill out a Form W-4 form to let your employer know just the right amount to keep more money in your pocket during the year instead.

Now, with that said, let’s look at ways you might be able to increase your tax refund that don’t involve over-withholding.

1. Contribute to a traditional IRA

You can lower your 2022 taxable income, which generally lowers your tax liability, by contributing to a traditional individual retirement account (IRA) for the 2022 tax year before the contribution deadline, which is April 18. This is because contributions to traditional IRAs, unlike those to Roth IRAs, are tax-deductible for the applicable tax year, which means they lower your taxable income.

Even if you are contributing to your employer’s 401(k) at work, you might also be able to put money away in your traditional IRA. Not everyone is eligible to contribute to an IRA, though, and the IRS does limit contribution amounts, so check the IRA account limits.

2. Contribute to an HSA

If you have a high-deductible health insurance plan, you can put money away in your health savings account (HSA) for the 2022 tax year until the April 18 deadline. An HSA contribution can help lower your amount of taxable income.

Keep in mind, HSA dollars can stay in your HSA account until you need them. See what amount you are eligible to put into your HSA account by checking the contribution limits.

3. Contribute to an Archer MSA

Self-employed individuals and small-business employees generally can contribute to an Archer medical savings account (MSA) if they are covered by a high-deductible health plan. The deadline for contributions to an Archer MSA for the 2022 tax year is April 18.

An Archer MSA is similar to an HSA is that it is a type of tax-advantaged account in which someone can save money for qualified medical expenses — and that contributions are tax-deductible.

4. Pick the most valuable tax-filing status

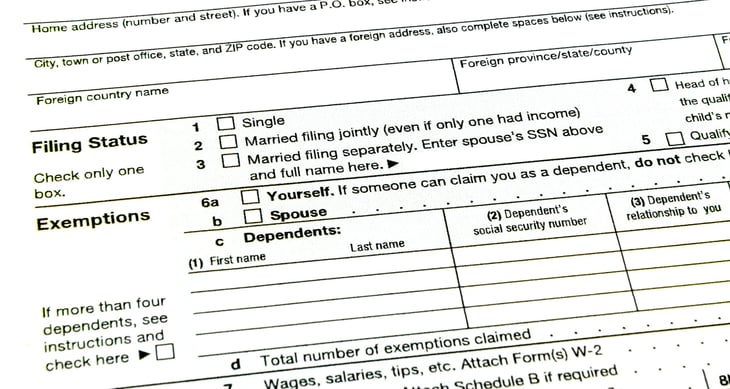

When you prepare your tax return, you will need to determine what tax-filing status best fits your situation. This is crucial because your filing status determines the amount of your standard deduction, which is easily the biggest federal income tax deduction that most people receive.

Filing statuses are essentially technical terms to the IRS, so they don’t necessarily mean what you might think. For example, not everyone who is single should choose “single” as their filing status. If they are eligible for the head of household status or qualifying surviving spouse status — both of which have a higher standard deduction than the single status — they could save hundreds of dollars or more in taxes by choosing head of household or surviving spouse instead of single.

Another possible pitfall to be aware of is that the married filing separately status has disadvantages. For example, people who claim that status are ineligible for certain tax credits, such as education credits. So married couples should weigh all pros and cons when deciding whether to file jointly or separately.

The IRS offers a free What Is My Filing Status? tool to help you determine which status is best for your situation.

5. Make sure you get every tax break you qualify for

With many tax credits reverting to pre-pandemic limits or being discontinued altogether for the 2022 tax year, refunds might be smaller than the last time you filed. So it’s especially important to take the time to be sure you’re getting every credit and deduction that applies to your situation.

Not sure what credits or deductions you qualify for? Visit the IRS website to see if there are any you’ve missed before filing.

6. Get a second opinion

Whether you see a paid tax pro or one of the many qualified tax volunteers across the country, consider getting a review of your tax return before you file it to make sure you haven’t missed any credits or deductions.

Free programs like Volunteer Income Tax Assistance (VITA) and Tax Counseling for the Elderly (TCE) can file your tax return at no charge, although you might need to make an appointment to meet with one of their volunteers.