Managing money wisely is essential for a secure and stable future. However, some individuals exhibit unmistakable signs of making bad financial choices that can lead to significant consequences. From excessive spending to neglecting financial responsibilities, these behaviors can act as warning signals of financial trouble ahead.

1. Lavish Spending on Non-Essentials

Individuals who consistently splurge on luxurious items without considering their financial stability send a clear message about their poor money management skills. Their obsession with designer clothes, high-end gadgets, and extravagant vacations often overshadows the importance of saving for emergencies and securing their financial future.

2. Frequent Payday Loans and Cash Advances

Reliance on payday loans and cash advances indicates a worrisome pattern of living paycheck to paycheck, leaving little room for savings or investments. These individuals often find themselves trapped in a cycle of debt due to exorbitant interest rates and fees associated with these short-term loans.

3. Ignoring Bills and Payment Due Dates

People who habitually miss payment due dates for bills and credit cards showcase a lack of financial responsibility. Late payments can lead to accumulating interest charges, penalty fees, and damage to their credit score, which can have long-term repercussions on their financial well-being.

4. Gambling and Risky Investments

Individuals who frequently indulge in gambling or speculative investments reveal their inclination towards risky behavior with money. They often prioritize the excitement of potential big wins over the consideration of potential losses, which can severely impact their financial stability.

5. No Emergency Savings Fund

Lack of an emergency savings fund is a clear indicator of poor financial planning. When unexpected expenses arise, these individuals may be forced to resort to borrowing money or using credit cards, further adding to their debt burden.

6. Impulsive Shopping and Retail Therapy

Using shopping as a coping mechanism or engaging in retail therapy to relieve stress is a sign of poor emotional management that can lead to significant financial strain. These individuals tend to accumulate unnecessary items and end up with little savings to fall back on.

7. Multiple Maxed-Out Credit Cards

Carrying multiple maxed-out credit cards demonstrates a lack of financial discipline and an inability to manage credit responsibly. The high credit card balances can lead to overwhelming debt, negatively impacting their credit score and future borrowing opportunities.

8. Lack of Retirement Planning

Individuals who neglect retirement planning may find themselves unprepared for their golden years. Failure to contribute to retirement accounts or invest in pension plans can result in financial insecurity during retirement, relying solely on social benefits or others for support.

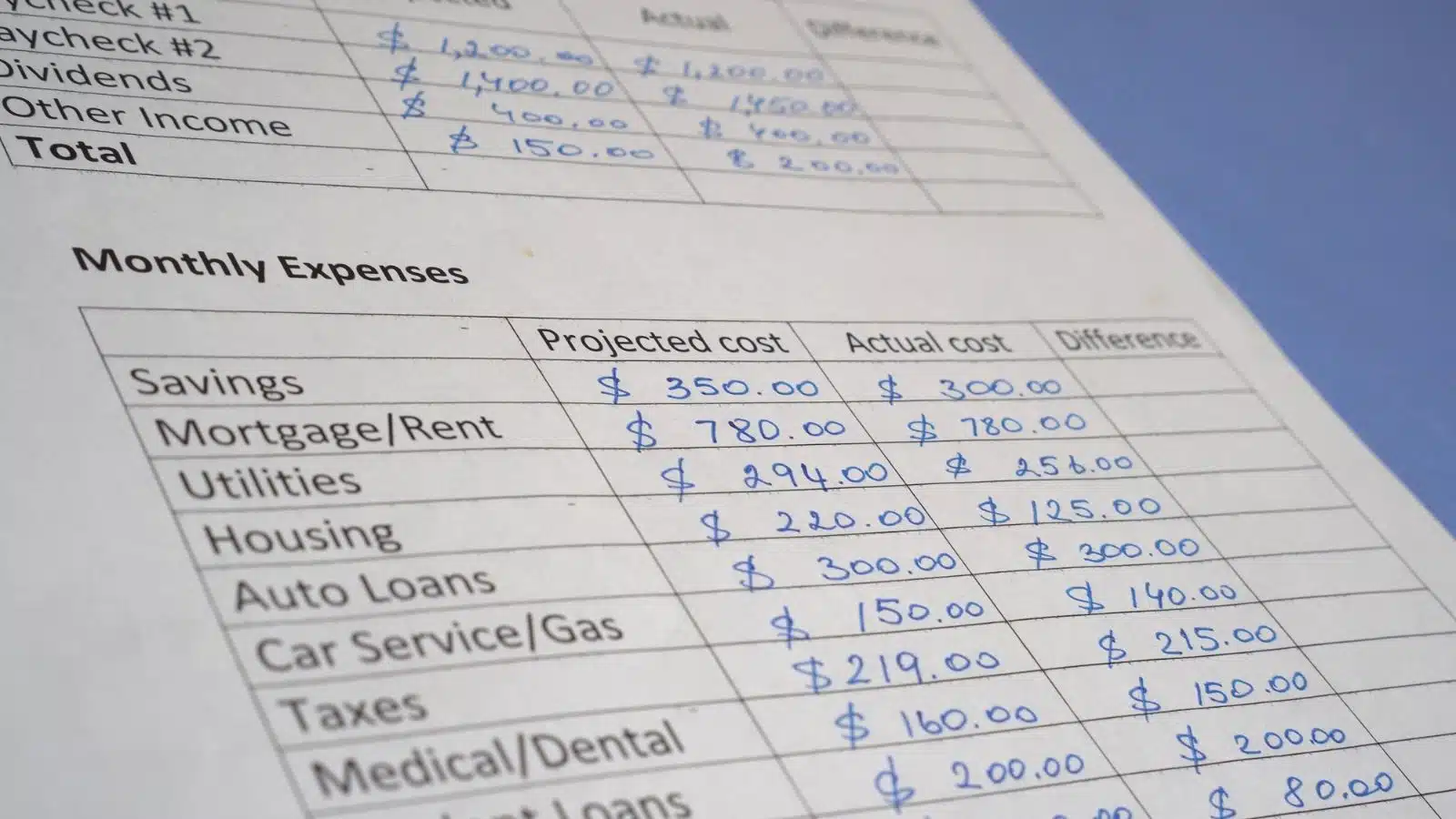

9. No Budgeting or Financial Goals

A lack of budgeting or setting clear financial goals indicates a lack of financial awareness and direction. Without a solid plan in place, these individuals may struggle to control their spending, save effectively, or work towards achieving their dreams.

10. Borrowing Money Without Repayment Plans

People who frequently borrow money from friends, family, or acquaintances without clear plans for repayment demonstrate a disregard for financial obligations and the trust of others. This behavior can strain relationships and lead to more serious financial problems in the future.

11. Constantly Living Beyond Means

Individuals who consistently spend more money than they earn demonstrate a lack of financial prudence. Relying heavily on credit cards or loans to sustain a lifestyle beyond their means can lead to a perpetual cycle of debt and financial instability.

12. Ignoring Financial Statements and Bills

Avoiding financial statements and bills can indicate a lack of accountability and financial awareness. Neglecting to review bank statements, credit card bills, or utility invoices may lead to late payments, missed opportunities for savings, and potential fraudulent activities going unnoticed.

50 Super Simple Side Hustle Ideas

50 Super Simple Side Hustle Ideas (& How to Make Them Work)

10 Frugal Lessons I Learned From Being Flat Out Broke

How To Make Money Without a Job

How To Make Money Without a Job

Creative Ways To Make Money

20 Easy Ways to Raise A Credit Score Fast

Read More: 20 Easy Ways to Raise A Credit Score Fast

Frugal Living Tips: The Essential Guide To Start Saving Money

Frugal Living Tips: The Essential Guide To Start Saving Money