Money can be tricky, and almost everyone is bound to stumble upon a few financial pitfalls at some point in their lives. However, some mistakes are more costly than others. So, before you make purchases or investments you’ll regret, check out this list of these major pitfalls to avoid. Whether it’s the allure of instant gratification, the temptation to overspend, or the failure to plan for the future, making terrible financial decisions is a universal experience.

1. Neglecting Insurance

Insurance is a safety net that many individuals overlook until they face a crisis. Some people may skip purchasing essential insurance policies like health, life, or disability insurance, believing that they can do without them. Neglecting insurance can expose individuals and their families to financial hardship in the event of illness, accidents, or unexpected tragedies, highlighting the importance of adequate coverage.

2. The Overextending Mortgage

Homeownership is a dream for many, but it can turn into a financial nightmare if not approached with caution. Some individuals fall into the trap of buying a home that stretches their budget to the limit, often relying on variable-rate mortgages or interest-only loans to afford the property.

Follow Invested Wallet For More

If you’ve enjoyed reading our content and are passionate about learning wealth, managing your finances, and achieving financial freedom, we’d love for you to join our community! Click here to follow Invested Wallet for more.

3. The Impulsive Splurge

We’ve all been there – that irresistible urge to treat oneself to an extravagant purchase. Whether it’s a designer handbag, the latest tech gadget, or a luxurious vacation, the impulsive splurge can wreak havoc on one’s finances. People often succumb to the allure of instant gratification, neglecting their long-term financial goals for the sake of a fleeting moment of pleasure.

4. The Credit Card Debt Spiral

Credit cards can be both a blessing and a curse. Many individuals find themselves ensnared in the web of credit card debt at least once in their lives. It often starts innocently, with a small balance that gradually snowballs into an overwhelming debt load. The convenience of swiping a card can make it easy to overspend and accumulate interest charges.

The allure of minimum payments and the postponement of facing the debt can be enticing, leading people deeper into the spiral. Ultimately, escaping this cycle can be challenging, and it can take years to regain financial stability.

5. Ignoring the Importance of Saving

In the hustle and bustle of daily life, saving money often takes a backseat to immediate expenses and desires. Many individuals delay or completely ignore building an emergency fund or saving for retirement. This neglect of saving can result in financial vulnerability when unexpected expenses arise, such as medical bills or car repairs.

Ignoring the importance of saving can lead to a lack of financial security and peace of mind, making people more susceptible to financial shocks and crises.

6. Falling for Get-Rich-Quick Schemes

The allure of quick wealth can be irresistible, and many people have, at some point, fallen for get-rich-quick schemes. These schemes promise extraordinary returns with minimal effort or risk. Whether it’s cryptocurrency investments, pyramid schemes, or day trading, individuals may be enticed by the prospect of easy money.

Unfortunately, most get-rich-quick schemes are nothing more than scams, and those who invest often end up losing their hard-earned money. Such decisions can result in financial setbacks and valuable lessons about the importance of prudent financial planning.

7. Neglecting Retirement Savings

Life’s demands often lead individuals to put off saving for retirement. With bills to pay and immediate financial responsibilities, retirement planning can easily be pushed to the back burner. Many people underestimate the importance of early retirement savings, only to find themselves scrambling to catch up in later years.

8. Co-Signing a Loan

Being asked to co-sign a loan for a friend or family member can be a difficult situation to navigate. While the intention is often to help a loved one, co-signing carries substantial financial risks. When the primary borrower defaults on the loan, the co-signer is left responsible for the debt.

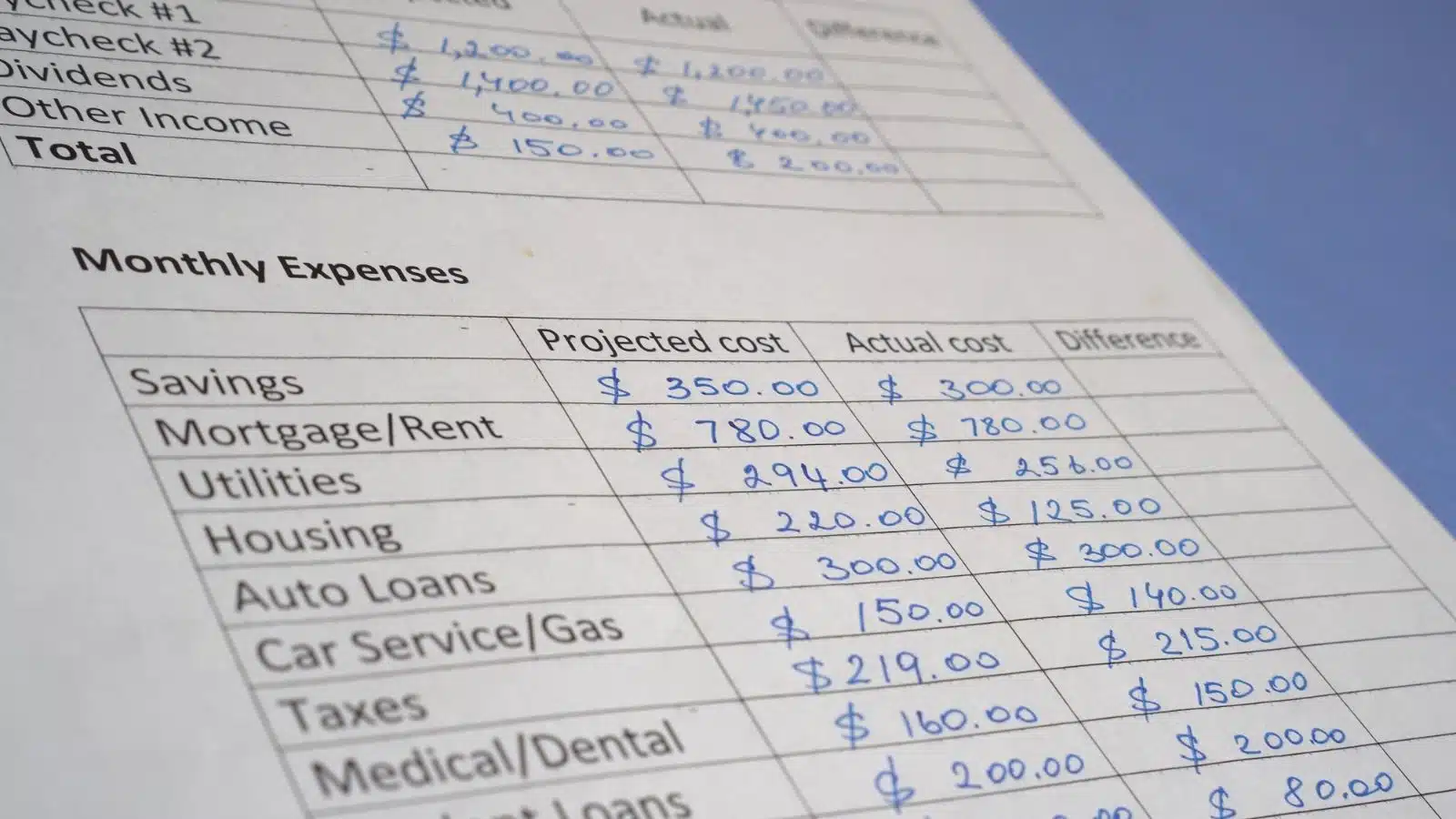

9. Ignoring Budgeting

Budgeting is a critical aspect of managing one’s finances, yet many people choose to ignore it. Without a clear budget, individuals may overspend on discretionary expenses, fail to save, and accumulate unnecessary debt.

10. Chasing After Market Hype

The financial markets are filled with trends, fads, and investment opportunities that capture the imagination of investors. Some individuals succumb to the lure of chasing after market hype, pouring money into hot stocks, cryptocurrencies, or speculative assets without proper research. Chasing market hype can lead to substantial losses when the bubble bursts or when investments do not pan out as expected, often causing disappointment and financial setbacks.

11. Falling for the “Buy Now, Pay Later” Trap

In the age of e-commerce, the “buy now, pay later” option can be a tempting way to acquire goods without immediate payment. While it provides convenience, this financial decision can lead to accumulating multiple small debts over time, potentially spiraling into a situation of financial uncertainty.

12. Neglecting to Build an Emergency Fund

Life is unpredictable, and unexpected expenses are a part of it. Some individuals overlook the importance of building an emergency fund, leaving them financially vulnerable when unforeseen circumstances like medical bills or car repairs arise.

10 Frugal Lessons I Learned From Being Flat Out Broke

I was living in the middle of a big city all by myself and paying my bills on a server’s salary. I had zero savings and was living paycheck to paycheck just to get by; frugal living was a necessity.

Read More: 10 Frugal Lessons I Learned From Being Flat Out Broke

Follow Invested Wallet For More

If you’ve enjoyed reading our content and are passionate about learning wealth, managing your finances, and achieving financial freedom, we’d love for you to join our community! Click here to follow Invested Wallet for more.