Achieving financial security is a crucial goal for many people, but it can be challenging to know where to start. Whether you’re just starting to build your financial foundation or looking to strengthen your existing plan, there are some crucial money moves you should be making to secure your financial future.

1. Start Saving as Early as Possible

Saving money is an essential aspect of financial planning. The earlier you start saving, the more time your money has to grow. A good rule of thumb is to save at least 20% of your income. You can start by setting up an emergency fund covering your living expenses for six months. You can also consider opening a retirement account, such as an IRA or 401(k), to take advantage of compound interest.

2. Invest Wisely

Investing your money can help you grow your wealth over time. However, it’s essential to do your research and invest wisely. Diversify your portfolio to reduce the risk of losing money. You can also consider working with a financial advisor who can provide personalized investment advice. Remember to review your investments regularly and make adjustments as needed.

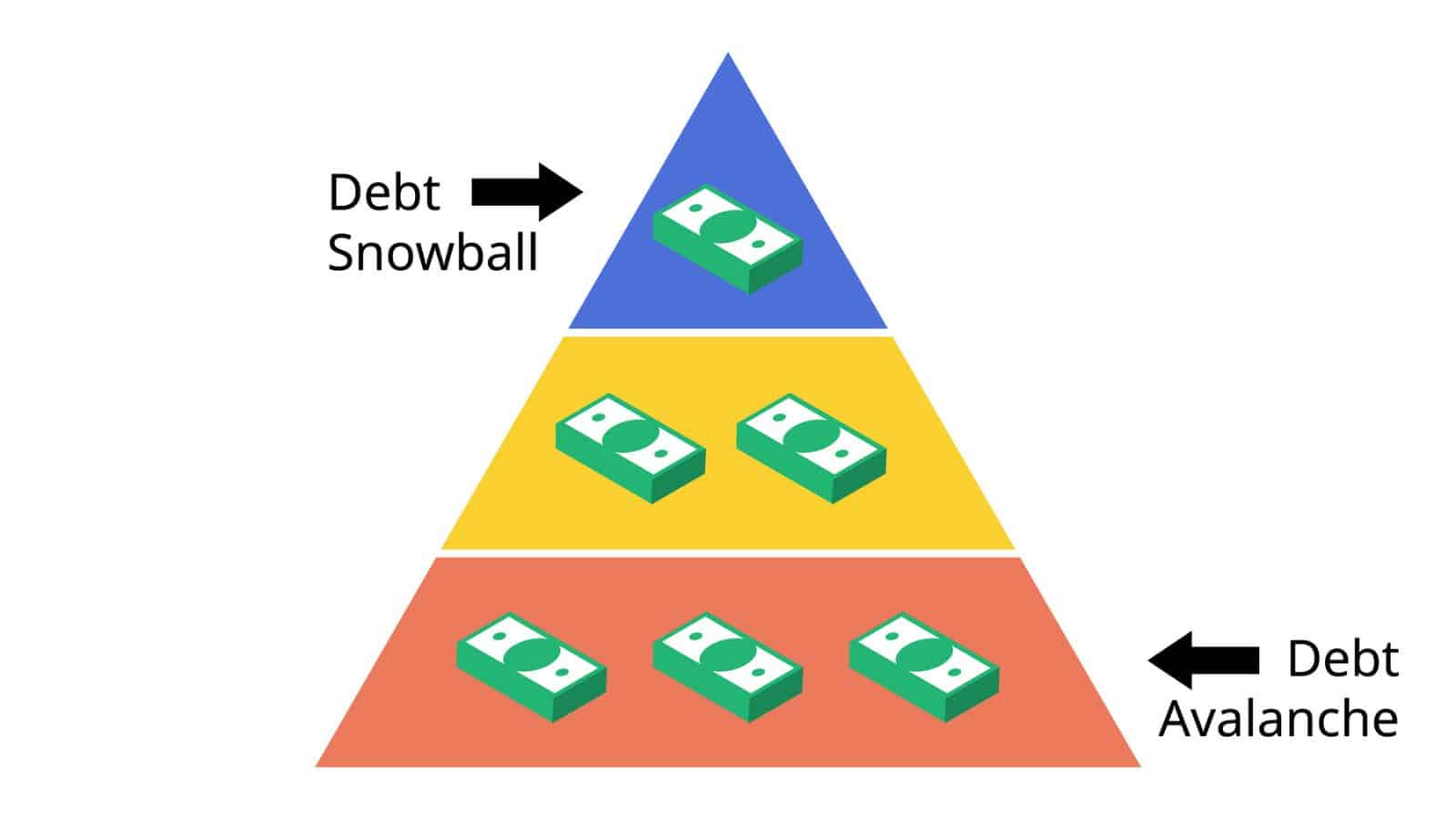

3. Pay Off High-Interest Debt

Paying off high-interest debt should be a top priority in your financial plan. High-interest debt, such as credit card debt, can accumulate quickly and be challenging to pay off. Start by creating a budget and identifying areas to cut back on expenses. Consider consolidating your debt or negotiating a lower interest rate with your creditors. Once you’ve paid off your high-interest debt, pay off other debts, such as student loans or car loans.

4. Increase Your Earning Potential

Increasing your earning potential can help you achieve your financial goals faster. You can do this by acquiring new skills, taking on additional responsibilities at work, or starting a side business. You can also consider furthering your education, which can lead to higher-paying job opportunities. Remember to negotiate your salary or hourly rate, especially when starting a new job or taking on a new role.

5. Protect Your Assets

Protecting your assets is an essential part of securing your financial future. Consider purchasing insurance, such as homeowners insurance, auto insurance, or life insurance, to protect your assets in the event of an unexpected event. You can also consider setting up a trust to protect your assets and ensure they’re distributed according to your wishes. Remember to review your insurance policies and estate plan regularly and make updates as needed.

6. Create a Long-Term Financial Plan

Creating a long-term financial plan is crucial in securing your financial future. Your financial plan should include your financial goals, such as saving for retirement, buying a home, or paying off debt. It should also include a budget that outlines your income and expenses and a plan for saving and investing. Consider working with a financial advisor who can help you create a personalized plan and provide guidance along the way.

7. Build a Diversified Investment Portfolio

A diversified investment portfolio can help you manage risk and maximize your returns. Consider investing in various assets, such as stocks, bonds, and real estate. You can also consider investing in alternative assets like cryptocurrency or peer-to-peer lending. Remember to review your portfolio regularly and make adjustments as needed to ensure that it aligns with your financial goals and risk tolerance.

8. Maximize Your Retirement Savings

Maximizing your retirement savings is an essential part of securing your financial future. Review your retirement savings regularly and adjust your contributions as needed to ensure you’re on track to meet your goals. If your employer offers a 401(k) or similar retirement plan, contribute enough to take advantage of any matching contributions. Consider contributing to an IRA or Roth IRA, which can provide tax advantages and flexibility.

9. Protect Yourself With Adequate Insurance Coverage

Protecting yourself with adequate insurance coverage can help you avoid financial disaster in the event of an unexpected event. Consider purchasing health insurance, disability insurance, and long-term care insurance to protect your health and income. You can also consider umbrella insurance, which covers additional liability beyond your primary policies. Remember to review your insurance coverage regularly and update as needed to ensure you’re adequately protected.

10. Continuously Educate Yourself About Personal Finance

Continuously educating yourself about personal finance can help you make informed decisions and stay on track with your financial goals. Read books and articles about personal finance, attend seminars or webinars, and listen to podcasts or watch videos on the subject. Consider joining a local or online community of like-minded individuals who can provide support and guidance along the way.

50 Super Simple Side Hustle Ideas

50 Super Simple Side Hustle Ideas (& How to Make Them Work)

10 Frugal Lessons I Learned From Being Flat Out Broke

How To Make Money Without a Job

How To Make Money Without a Job

Creative Ways To Make Money

20 Easy Ways to Raise A Credit Score Fast

Read More: 20 Easy Ways to Raise A Credit Score Fast

Frugal Living Tips: The Essential Guide To Start Saving Money

Frugal Living Tips: The Essential Guide To Start Saving Money